Is this the right time to invest in automotive stocks?

The automotive industry was already suffering a massive slowdown, and the coronavirus pandemic has only made matters worse. With stock prices of automobile manufacturers plummeting, is this the right time to invest?

The automotive industry was already suffering a massive slowdown, and the coronavirus pandemic has only made matters worse. With stock prices of automobile manufacturers plummeting, is this the right time to invest?

Let’s face it, the past year or so hasn’t quite been very fruitful for automobile manufacturers and ancillary firms. While it is impossible to attribute the downturn to any single reason, there are multiple factors that have directly or indirectly resulted in the slowdown. The switch to BS-VI emission norms and the resultant increase in cost of vehicles, the general slowdown of the global economy and more recently the coronavirus pandemic that has shaken up the world. But just how much has all this affected the automotive industry.

A few days back, Maruti Suzuki released its sales numbers for the month of March 2020. The Manesar-based carmaker only managed to sell a total of 83,792 units last month inclusive of exports. In the domestic market, the company registered just 76,976 units. This is, of course, the sale they could manage in three weeks – the nation has been under complete lockdown from 22nd March. In the financial year ending March 31st, Maruti Suzuki posted a degrowth of over 16 percent. Needless to say, all of this has a direct impact on the share price as well.

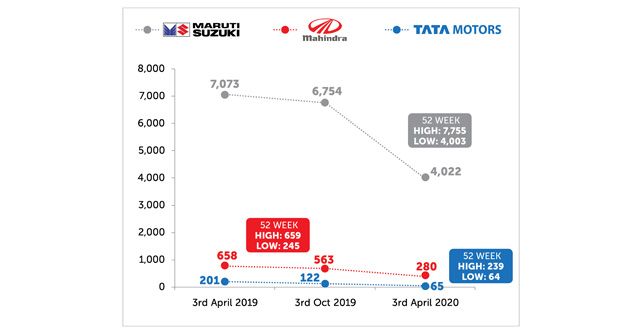

At the end of business hours on 3rd April 2019, Maruti Suzuki’s stock was priced at Rs 7,073. With the company registering lower numbers in the first six months of FY2019-20, the share prices were constantly dipping. The festive season in October 2019 brought some relief, but that too was short lived.

The case is similar for other carmakers as well. Take Tata Motors for instance. While they haven’t shared their March numbers as yet, February hasn’t been very promising either. Tata registered 12,430 units in February this year in comparison to 17,818 units in the same month last year. Mahindra too has suffered an insane 57% drop in sales in the month of February 2020.

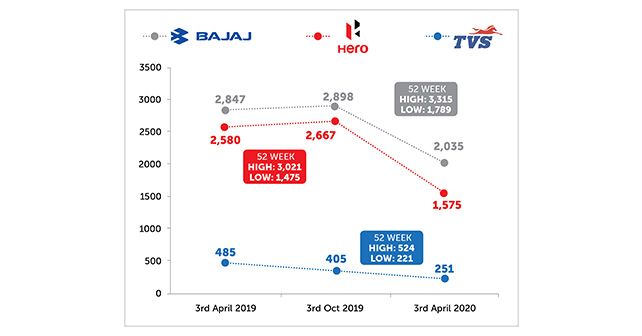

Two-wheeler manufacturers are facing similar challenges too. In February, a sum total of 12,94,195 two-wheelers were sold in the country – down 20 percent from the corresponding month in 2019. Sales numbers for the FY2019-20 of all two-wheeler manufacturers are down too. A year ago, Hero Moto Corp share was priced at Rs 2,580, today it is valued at just over Rs 1,500. Bajaj Auto share story is quite similar too, down from Rs 2,847 on 3rd April last year to Rs 2,020 at the end of business hours today.

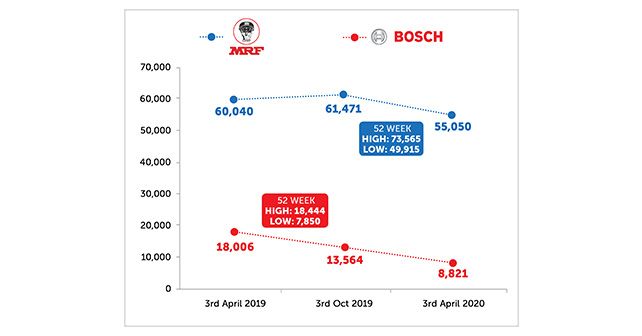

Keeping in mind that car and bike manufacturers have been hit hard, auto ancillary companies like MRF, Bosch and more, are bearing the burnt too. Here’s a look at how share prices of some of the most prominent automobile companies have dropped over the past one year:

Considering that the country will continue to be under a complete lockdown till 14th April (and possibly even after that), sales this month are expected to drop even further. And even after all other things ‘normalise’, it will surely be a while before automotive sales get back on track. In that context, it might be a good idea to start tracking automotive company share prices immediately and purchase them while they are near rock bottom. Sure, they may not give you immediate or short-term gains, but companies like Maruti Suzuki, Hero MotoCorp, Bajaj Auto and MRF are good, safe shares to invest in for the long run.

Also Read:

Write your Comment on