Electric vehicles free from all registration charges in India

In a bid to further strengthen the uptake of EVs in the country, the Ministry of Road Transport & Highways (MoRTH) has officially confirmed that EVs, from now on, will be exempt from paying any registration charges in India.

Though many Indian states have already exempted EVs from road or registration charges, the latest MoRTH notification is likely to bring more uniformity into the system.

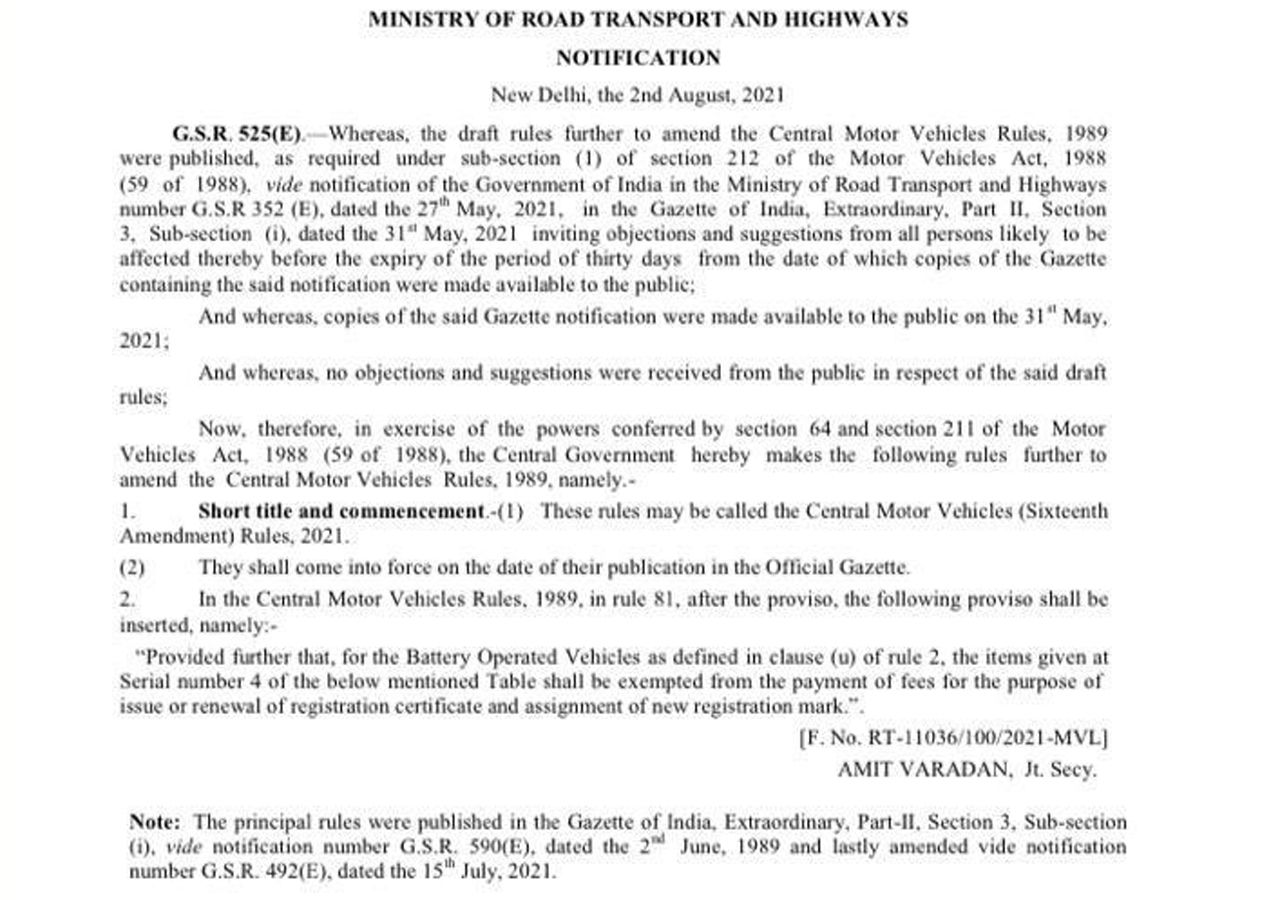

In a bid to further strengthen the uptake of EVs in the country, the Ministry of Road Transport & Highways (MoRTH) has officially confirmed that EVs, from now on, will be exempt from paying any registration charges in India. The original Gazette notification states that EVs 'shall be exempted from the payment of fees for the purpose of issue or renewal of registration certificate and assignment of a new registration mark.' The draft notification for the same was released in May 2021.

MoRT&H has issued a notification dated 2nd August 2021 to exempt Battery Operated Vehicles from the payment of fees for the purpose of issue or renewal of registration certificate and assignment of the new registration mark. This has been notified to encourage e-mobility. pic.twitter.com/PkPctyjWQz

— MORTHINDIA (@MORTHIndia) August 3, 2021

However, although many states, as part of their independent EV policies, have already waived off all registration charges for EVs in their respective regions, MoRTH's latest notification pertains to the amendment of the Central Motor Vehicles Rules, 1989, which means that this notification shall be applicable across the country, thereby bringing more clarity and uniformity to the overall framework.

Plus, exemptions like these are also the need of the hour when it comes to the EV sales figures in the country. Due to the imposition of numerous COVID-19-related lockdowns, EV sales for FY21 witnessed a drop of nearly 20%, when compared to the FY20 figure. Thus, in a challenging scenario like this, such exemptions play a very crucial role in providing an incentive and encouragement to prospective EV buyers.

Read more:

Delhi EV Policy: Battery-operated vehicles now exempt from road tax

Why the national vehicle scrapping scheme may be ineffective in Delhi-NCR

Effective April 2022, vehicle scrappage policy approved for govt vehicles

-(1).webp)

Write your Comment on